“That’s what I used to think! In fact, before I became a licensed real estate agent, I did several FSBO (For Sale By Owner) sales and THOUGHT I knew what I was doing. But if I had known then what I know now…I never would have risked it. Here’s what I’ve learned…” –Sheila Cox

Yes…You Need a Partner During the Home Buying Process!

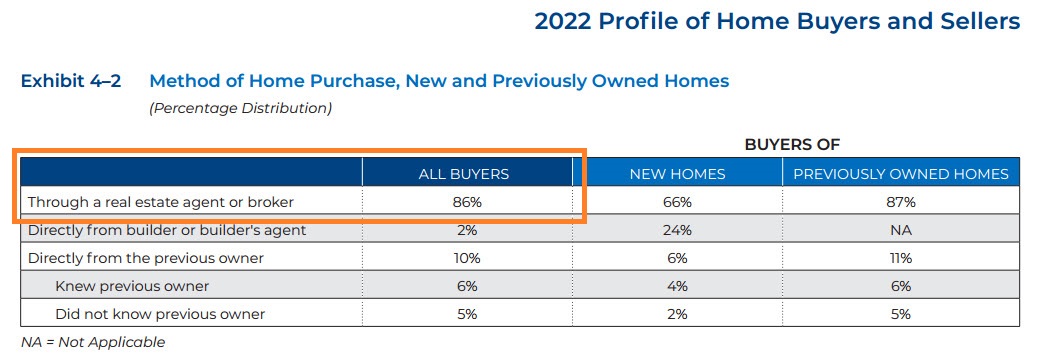

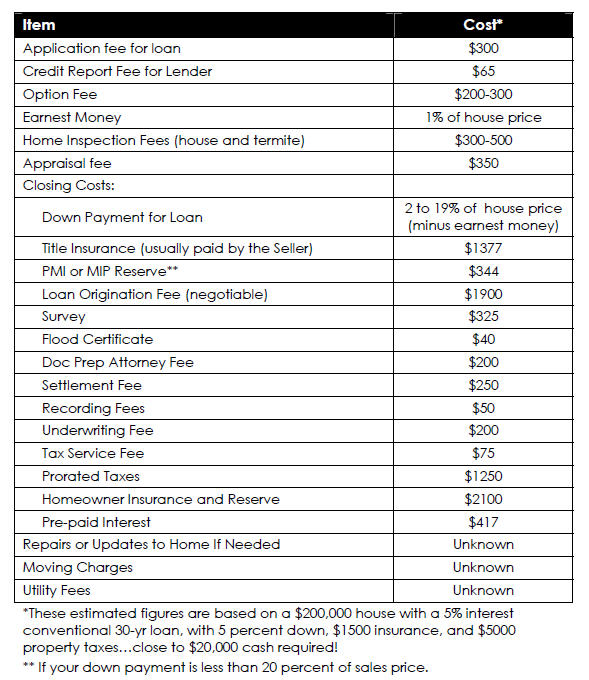

Your home is probably your largest single financial investment. Most homes in my area (Katy and Sugar Land TX) cost over $200,000. If you had a $200K legal problem would you try to handle it yourself or would you high a quality attorney to help you?

Of course, not all attorneys are equal in skills, knowledge, integrity, experience–and neither are all real estate agents. In fact, most people have had at least one bad experience with a low-quality real estate agent. I know I have! As in any industry, please consider that it is possible the 80-20 rule applies to real estate agents…maybe 20 percent are not very highly qualified, but that would leave another 80 percent who are! (Just like in your line of work…do all your peers provide the same quality of expertise?) Always keep in mind that having a bad experience with one agent, doesn’t mean that all real estate agents are bad. The trick is finding and hiring the right, high-quality agent. Here are some things to consider…

Real Estate Laws Vary From State to State

Not all states have the same real estate laws. In fact, Texas real estate laws and practices are highly unique in comparison to other states. Just because you have bought or sold a home in another state, does not necessarily make you qualified to do so in Texas. (I know, I know…we Texans think everything is bigger and better here!) But the fact is, Texas real estate is so complicated, that agents are required to have many more hours of education to get a license here than any other state…about three times more hours of education than average across other states!

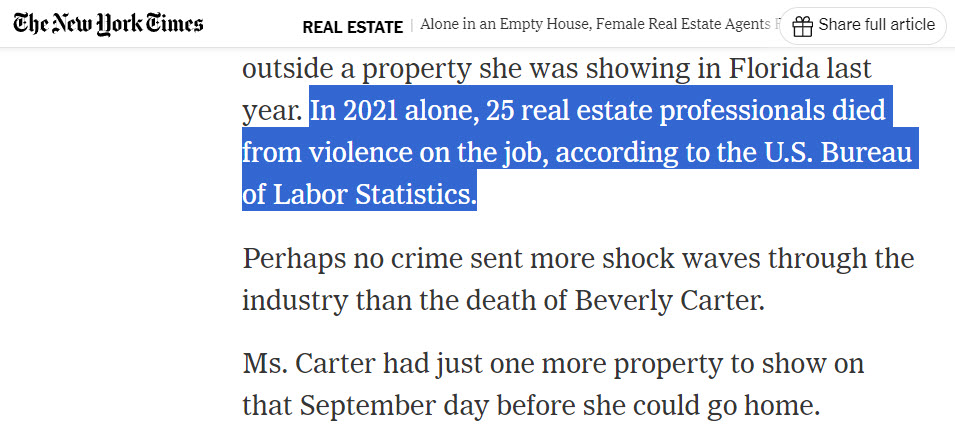

Your Legal Exposure in a Real Estate Transaction Can Be Very High

A very common type of real estate lawsuit involves Deceptive Trade Practices in which a home buyer accuses the home seller for not properly disclosing the actual condition of the property. In these cases, treble damages (three times the actual cost) can be awarded. This can really add up! And the cost for hiring a real estate attorney to defend yourself can cost well over $10,000! It doesn’t always matter that you did nothing wrong. Without a licensed real estate agent there to watch out for your interests and to make sure that you comply with all of the Texas real estate code and statutes, you can end up with a real nightmare on your hands.

A very common type of real estate lawsuit involves Deceptive Trade Practices in which a home buyer accuses the home seller for not properly disclosing the actual condition of the property. In these cases, treble damages (three times the actual cost) can be awarded. This can really add up! And the cost for hiring a real estate attorney to defend yourself can cost well over $10,000! It doesn’t always matter that you did nothing wrong. Without a licensed real estate agent there to watch out for your interests and to make sure that you comply with all of the Texas real estate code and statutes, you can end up with a real nightmare on your hands.

Likewise, home owners can sue home buyers for non-performance or can keep large amounts of earnest money if a contract doesn’t Close. This is when you want a professional agent looking out for your best interest to (hopefully) prevent you from breaching a contract and losing your earnest money. And if a lawsuit is not prevented, isn’t it best to have a large, reputable real estate brokerage (and their legal team) behind you when you need it?

Real Estate Data Is Not a Matter of Public Record In Texas

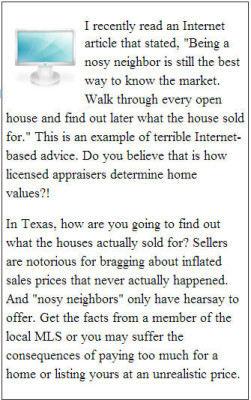

Texas is one of 14 non-disclose or partially-disclose states in the U.S. That means that real estate sales prices are not a matter of public record in Texas. So Internet-based companies like Zillow and Trulia do not have the real data to accurately “Zestimate” what a house is worth in our state. Property tax records are what these companies use in order to estimate a home’s value. But everyone in Texas knows that tax appraisal values do not usually reflect the actual value of a home…they are typically lower than actual value. (Which helps to keep the costs of our already too-high property taxes down.)

Texas is one of 14 non-disclose or partially-disclose states in the U.S. That means that real estate sales prices are not a matter of public record in Texas. So Internet-based companies like Zillow and Trulia do not have the real data to accurately “Zestimate” what a house is worth in our state. Property tax records are what these companies use in order to estimate a home’s value. But everyone in Texas knows that tax appraisal values do not usually reflect the actual value of a home…they are typically lower than actual value. (Which helps to keep the costs of our already too-high property taxes down.)

The only people in Texas who have accurate sales records are members of the Multiple Listing Service (MLS) including real estate agents and home appraisers. So if you want an accurate sales price analysis on a home (so that you don’t pay too much for it) you will need to hire one of these professionals.

CAUTION: Not all real estate agents are equally good at sales price analysis. Hire an agent who knows how to put together a valid comparative market analysis (CMA).

Source: https://www.zillow.com/zestimate/#acc

Do You Really Want (or Have the Time) To Learn Everything You Need To Know About Real Estate?

Yes, you can read up on real estate and I encourage you to do so. But no amount of book-learning is going to make up for the actual real-world experience a high-quality real estate agent offers. Real estate laws change yearly and vary from state-to-state. So most books are out-of-date by the time they go to print or are too generic to meet your specific state’s requirements.

Yes, you can read up on real estate and I encourage you to do so. But no amount of book-learning is going to make up for the actual real-world experience a high-quality real estate agent offers. Real estate laws change yearly and vary from state-to-state. So most books are out-of-date by the time they go to print or are too generic to meet your specific state’s requirements.

And please don’t believe all the real estate advice that you can read on the Internet. I recently read an Internet article about how to sell a home without a real estate agent and most of the advice offered was not accurate according to Texas real estate laws…which could get you into some costly legal trouble.

Besides all this…aren’t you busy enough with just deciding on a home, getting your lender all the necessary paperwork, planning the move, changing utilities, registering at new schools, packing, training for the new job, and so forth?

It’s Complicated! Are You Qualified to Manage the Entire Transaction?

A high-quality real estate agent wears many hats: local area expert, state real estate rules expert, amateur remodeler, price analyzer and mathematician, home decorator/stager, professional photographer and videographer, marketing expert, chauffer and tour guide, psychologist, marriage counselor, sales negotiator, amateur home inspector, administrative assistant, project/transaction manager, communications expert, and tech writer. Very few professions require skills in so many different areas! I don’t think the average person realizes how much they expect their real estate agent to handle.

And then there are the home buyers who think real estate agents just help them find a home to buy and once the contract is accepted, their job is over; but that’s just the “end of the beginning” for an agent! Likewise, a great listing agent doesn’t just take a few photos, put a sign in the yard, and wait for the offers. A great real estate agent is looking out for you every step of the way and keeping their eye on the other agent, the other party (buyer, seller, builder), the lender, the inspector, and the title company.

Here are more examples of what a real estate agent does for you:

- Helping you maneuver the Option Period, including getting the right inspections and, if necessary, repair estimates. Do you know how to “exercise your option” properly if needed? Do you know how to minimize the impact of the OP when marketing a home as a seller? How do you deal with lender-required repairs?

- Negotiating necessary repairs with the Seller so you don’t get stuck with them after Closing. Can you get repair estimates in a timely manner? Do you know how to effectively overcome common repair objections? Do you have the knowledge needed to accurately estimate a remodeling project?

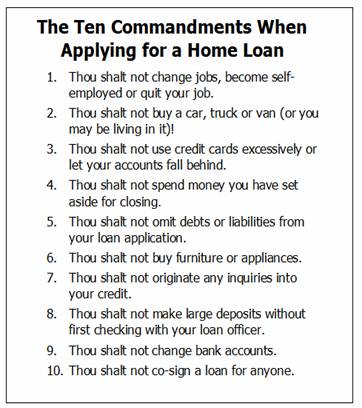

- Helping you meet your contractual obligations (such as appraisals, surveys, deed restrictions, HOA compliance certificates, legally required disclosures, title commitments, hazard insurance, and more) in a timely manner so you don’t find yourself in breach of contract. How many days do you have to get the survey? If there is an existing survey, what other legal document is required? What do you do if encumbrances are found in the title search? What do you do if your financing falls through after the deadline in your contract?

- Dealing with home inspectors, appraisers, lenders, and title companies to get them to do their jobs in a timely manner so you can move when you plan to. There are many moving parts in a real estate transaction! What do you do if the lender doesn’t get the paperwork to the title company on time? How do you know if the fees on the HUD1 are accurate? Did you remember to get hazard insurance and order the residential service contract? Did you negotiate a temporary lease so you can move out after Closing? What do you do if the Closing falls through?

Do You Know the Area As Well As You Need To?

If you are moving to a new area, there is no substitute for getting the opinions and advice of a local real estate expert. Even if you know someone who lives in the area that you are moving to…they only see that area from their individual, and probably limited, perspective. You really need a professional who has the BIG picture and the “inside information” that only a local real estate expert can provide. Someone who will listen to your specific needs and find the right neighborhood and right home for you.

If you are moving to a new area, there is no substitute for getting the opinions and advice of a local real estate expert. Even if you know someone who lives in the area that you are moving to…they only see that area from their individual, and probably limited, perspective. You really need a professional who has the BIG picture and the “inside information” that only a local real estate expert can provide. Someone who will listen to your specific needs and find the right neighborhood and right home for you.

And watch out for online companies offering you price reports and other types of statistics based on ZIP Codes. Sugar Land consists of multiple ZIP Codes and let me assure you that a price analysis for a home in Sweetwater in 77479 is not going to accurately reflect the price of a home located in Woodstream which is in the same ZIP Code.

Home prices vary not only from neighborhood to neighborhood, but even within the same neighborhood. For example, a home in New Territory that has a water view is going to be valued higher than a home right down the street that does not have a water view. And a 2000-2600sf home probably has a different average sales price/sf than a 3500-4100sf home…even on the same street. AND those same values can change from month to month (depending on the actual figures for recently closed home sales). Do you have the real sales data and price analysis expertise to ensure that you don’t pay too much for a home or list it at an unrealistic price?

Sometimes You Need An Objective Partner When Choosing the Right Home

Let’s face it…even the most level-headed, objective, analytical engineer-type can get emotional (and become unobjective) about a home. Trust me on this observation! Everyone gets emotional on some level about the house they are going to live-in for the next several years. And if you have raised four kids, two dogs, and three cats in a home for the past 23 years…forget about it. You may not see the worn-out carpet and outdated wallpaper for the good memories.

Let’s face it…even the most level-headed, objective, analytical engineer-type can get emotional (and become unobjective) about a home. Trust me on this observation! Everyone gets emotional on some level about the house they are going to live-in for the next several years. And if you have raised four kids, two dogs, and three cats in a home for the past 23 years…forget about it. You may not see the worn-out carpet and outdated wallpaper for the good memories.

Sometimes it is just like “love at first sight” when buying a home. And that emotional response to a home may cause you to do something you will regret later. You need an unattached, neutral, third-party (such as a dedicated real estate agent) to help keep you focused on the facts and the big picture. I’m not saying all agents do this. I agree that some agents are just out to close the deal no matter what, and don’t really care if you are going to end up with a poor investment that you will regret when resale time comes along.

But I once talked a client out of a $650,000 home because, when I was researching the home and looked at the bird’s eye view, I found a hidden dump where you could see railroad cars deteriorating and rusting into the local water supply! You never would have seen this driving around the neighborhood because it was hidden behind fences and shrubbery. But when I showed my clients what they would be living next to, even though they were disappointed because they loved the house, they were thankful that I found the problem and objectively pointed it out to them before they purchased that potentially costly mistake. I ended up selling them a $525K home they loved and we are very good friends to this date because they know I am trustworthy and not just looking out for the highest sales commission I can get.

List of My Valuable Services for Home Buyers

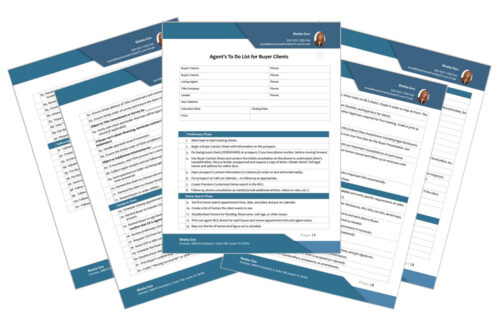

My job isn’t “just” helping you find a house to buy…I’m helping you through the entire 2-4 month process of buying a home. There are over 100 tasks that I perform during the purchasing process. I’m looking out for you every step of the way and keeping my eye on the listing agent, the seller, the builder (if applicable), the lender, the inspector, appraiser, HOA, and the title company. I’m on YOUR side because I’m YOUR agent.

I help with price analysis, contract negotiations, legal paperwork, inspections, appraisal issues, repair negotiations, home warranties, HOA compliance inspections, hazard insurance, surveys, title commitment, home warranties, and more. I have the expertise to help solve complicated problems that often occur in the process and I work to make sure that you don’t lose your earnest money or worse.

Real estate is a huge financial and legal commitment. Don’t you deserve to have a Five-Star real estate agent on your side?

If you haven’t already, you may want to see my List of My Value-Added Services for VIP Home Buyers so you know what to expect. Or you can download my brochure…

Here’s How I Add Value to Your Home Buying Process:

- Premium, customized home search (based on my knowledge of the area school ratings and flood zones) to filter out homes that don’t meet your criteria. PLUS, my search has the “Coming Soon” listings not available on Zillow, RedFin, etc. You can’t get this level of a home search on your own!

- Online home review BEFORE you tour a house, to look for potential defects such as high-risk flood zone, high-voltage power lines, MUD tanks, previous flooding, and other issues…so you don’t waste time touring undesirable homes.

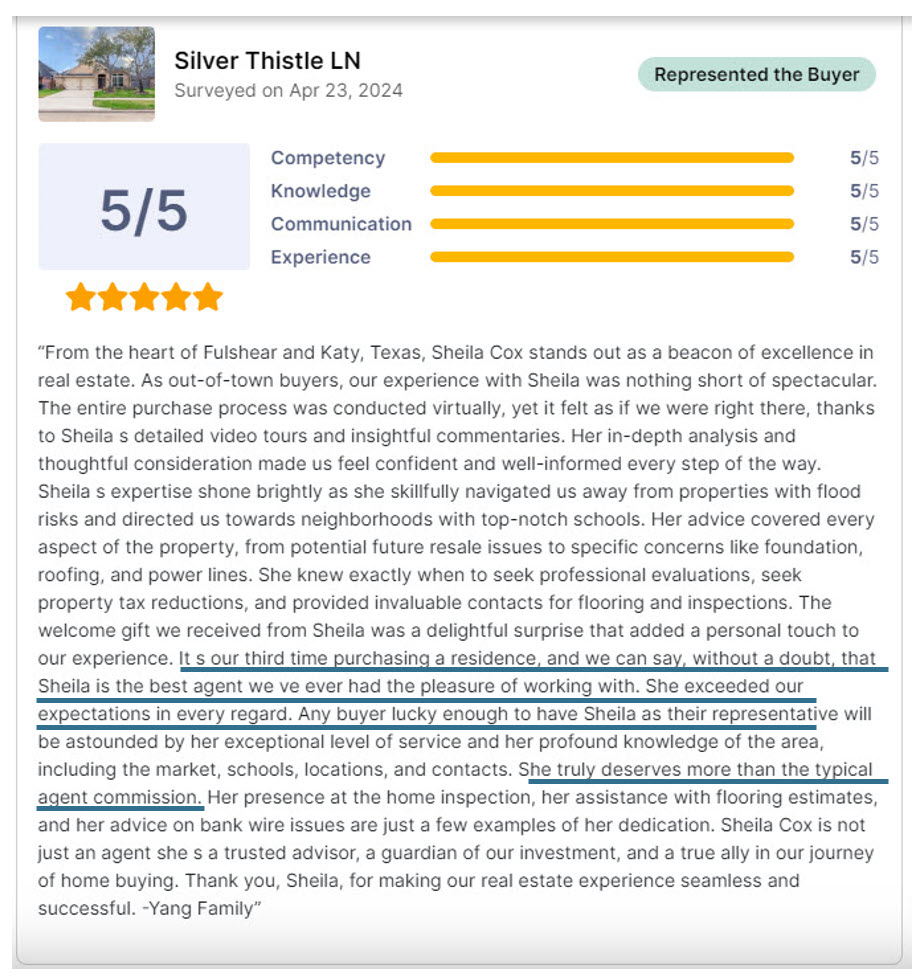

- Detailed home tours (in-person or via VIDEO* for out-of-town clients), where I help identify the features and benefits of each home and neighborhood as well as any potential home defects (so you don’t end up with a “money pit”).

*I’ve sold many homes “sight unseen” to out-of-state an out-of-country clients, via my HD video walkthroughs (view sample). I will even video the inspector summary and final walkthrough for you.

- Hyperlocal knowledge and expertise so I can point out the amenities, PROs and CONs, and HOA details of most neighborhoods in this area.

- “Sheila’s Home Buyer Guide” for THIS AREA (not generic) that includes helpful info about the INs and OUTs of the home buying process here in Texas. Remember that real estate laws are different from state to state.

- Detailed pricing data and expert Comparative Market Analysis (CMA) on the house you select to purchase, so you can make a good decision regarding the price. Pricing homes is my superpower! 😊

- Expert contract creation and negotiations to help you get the house you want…even in multi-offer situations.

- Assistance with hiring home inspectors, reviewing inspection reports, and guiding you on necessary repairs/costs so you make the wisest decision.

- Floorplans! I can create a floorplan of any home you purchase, whether provided by the home seller or not.

- Project management of all the legal deadlines and requirements throughout the transaction. You’ve got enough to deal with the packing, moving, and job/school relocation activities!

- Assistance in managing the title commitment/insurance process and working with the title company.

- Assistance with home surveys and their impact on your transaction.

- Assistance with appraisals and their impact on your transaction. I know how to protect you if the appraisal “comes in low” (which can happen in super-hot seller markets).

- Assistance with HOA compliance documents, fees, and procedures.

- Help with obtaining home owner’s insurance and flood insurance.

- Guidance with choosing a home warranty as needed.

- Helpful information regarding all the utilities (MUD info) applicable to the home you purchase.

- Helpful “Planning the Move” information and “Info About New Home” that will help make your transition easier.

- “Moving Survival Kit” provided as my Closing gift. This contains the things you will need on your moving day (but are usually packed) such as: soap, trash bags, paper plates, cups, toilet paper, snacks, box cutter, etc.

- Guidance on your homestead tax exemption and how to apply for it in a timely manner to reduce your property taxes.

- Helpful monthly home maintenance reminders, to take care of your investment!

Whew! That’s way more than “just” showing houses. 😄

Here are some other articles about “buyer representation”…

Summary

So let’s recap. Since…

…real estate laws vary from state to state and change every year,

…your legal exposure in a real estate transaction can be very high,

…real estate data is not a matter of public record in Texas, so you don’t really know what a specific house is really worth,

…you probably don’t have the time to learn everything you need to know about real estate

…it’s complicated and you may not be qualified to manage the entire transaction,

…you may not know the area as well as you need to know it, and

…you probably want an objective partner to help you choose the right home…

You should definitely hire a real estate agent to help you with your next real estate transaction!

When you purchase a resale home, you can purchase a home warranty (a.k.a., Residential Service Contract or RSV) that will protect you against most ordinary flaws and breakdowns for at least the first year of occupancy. The warranty may be offered by either the Seller, as part of the overall package, or by the agent. Even with a warranty, you should have the home carefully inspected before you purchase it.

When you purchase a resale home, you can purchase a home warranty (a.k.a., Residential Service Contract or RSV) that will protect you against most ordinary flaws and breakdowns for at least the first year of occupancy. The warranty may be offered by either the Seller, as part of the overall package, or by the agent. Even with a warranty, you should have the home carefully inspected before you purchase it.

A real estate “Closing” is where you and I meet with some or all of the following individuals: the Seller, the Seller’s agent, a representative from the lending institution and a representative from the title company, in order to transfer the property title to you. The purchase agreement or contract you signed describes the property, states the purchase price and terms, sets forth the method of payment, and usually names the date and place where the closing or actual transfer of the property title and keys will occur.

A real estate “Closing” is where you and I meet with some or all of the following individuals: the Seller, the Seller’s agent, a representative from the lending institution and a representative from the title company, in order to transfer the property title to you. The purchase agreement or contract you signed describes the property, states the purchase price and terms, sets forth the method of payment, and usually names the date and place where the closing or actual transfer of the property title and keys will occur.

After you find the right house

After you find the right house

A very common type of real estate lawsuit involves Deceptive Trade Practices in which a home buyer accuses the home seller for not properly disclosing the actual condition of the property. In these cases, treble damages (three times the actual cost) can be awarded. This can really add up! And the cost for hiring a real estate attorney to defend yourself can cost well over $10,000! It doesn’t always matter that you did nothing wrong. Without a licensed real estate agent there to watch out for your interests and to make sure that you comply with all of the Texas real estate code and statutes, you can end up with a real nightmare on your hands.

A very common type of real estate lawsuit involves Deceptive Trade Practices in which a home buyer accuses the home seller for not properly disclosing the actual condition of the property. In these cases, treble damages (three times the actual cost) can be awarded. This can really add up! And the cost for hiring a real estate attorney to defend yourself can cost well over $10,000! It doesn’t always matter that you did nothing wrong. Without a licensed real estate agent there to watch out for your interests and to make sure that you comply with all of the Texas real estate code and statutes, you can end up with a real nightmare on your hands. Texas is one of 14 non-disclose or partially-disclose states in the U.S. That means that real estate sales prices are not a matter of public record in Texas. So Internet-based companies like Zillow and Trulia do not have the real data to accurately “Zestimate” what a house is worth in our state. Property tax records are what these companies use in order to estimate a home’s value. But everyone in Texas knows that tax appraisal values do not usually reflect the actual value of a home…they are typically lower than actual value. (Which helps to keep the costs of our already too-high property taxes down.)

Texas is one of 14 non-disclose or partially-disclose states in the U.S. That means that real estate sales prices are not a matter of public record in Texas. So Internet-based companies like Zillow and Trulia do not have the real data to accurately “Zestimate” what a house is worth in our state. Property tax records are what these companies use in order to estimate a home’s value. But everyone in Texas knows that tax appraisal values do not usually reflect the actual value of a home…they are typically lower than actual value. (Which helps to keep the costs of our already too-high property taxes down.)

Yes, you can read up on real estate and I encourage you to do so. But no amount of book-learning is going to make up for the actual real-world experience a high-quality real estate agent offers. Real estate laws change yearly and vary from state-to-state. So most books are out-of-date by the time they go to print or are too generic to meet your specific state’s requirements.

Yes, you can read up on real estate and I encourage you to do so. But no amount of book-learning is going to make up for the actual real-world experience a high-quality real estate agent offers. Real estate laws change yearly and vary from state-to-state. So most books are out-of-date by the time they go to print or are too generic to meet your specific state’s requirements. If you are moving to a new area, there is no substitute for getting the opinions and advice of a local real estate expert. Even if you know someone who lives in the area that you are moving to…they only see that area from their individual, and probably limited, perspective. You really need a professional who has the BIG picture and the “inside information” that only a local real estate expert can provide. Someone who will listen to your specific needs and find the right neighborhood and right home for you.

If you are moving to a new area, there is no substitute for getting the opinions and advice of a local real estate expert. Even if you know someone who lives in the area that you are moving to…they only see that area from their individual, and probably limited, perspective. You really need a professional who has the BIG picture and the “inside information” that only a local real estate expert can provide. Someone who will listen to your specific needs and find the right neighborhood and right home for you. Let’s face it…even the most level-headed, objective, analytical engineer-type can get emotional (and become unobjective) about a home. Trust me on this observation! Everyone gets emotional on some level about the house they are going to live-in for the next several years. And if you have raised four kids, two dogs, and three cats in a home for the past 23 years…forget about it. You may not see the worn-out carpet and outdated wallpaper for the good memories.

Let’s face it…even the most level-headed, objective, analytical engineer-type can get emotional (and become unobjective) about a home. Trust me on this observation! Everyone gets emotional on some level about the house they are going to live-in for the next several years. And if you have raised four kids, two dogs, and three cats in a home for the past 23 years…forget about it. You may not see the worn-out carpet and outdated wallpaper for the good memories.