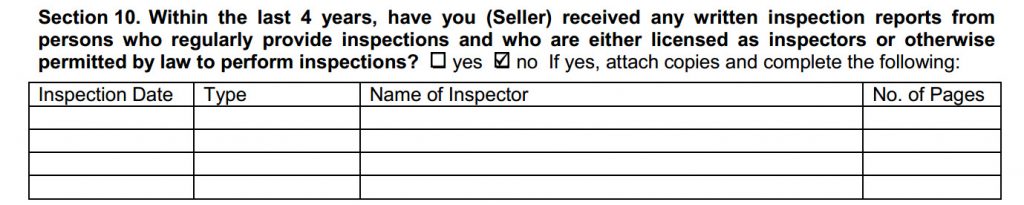

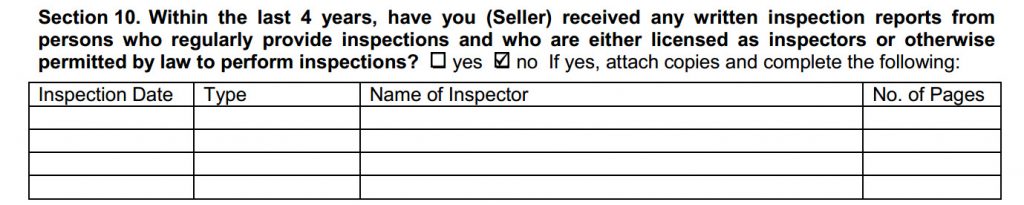

When you are selling your home, you may be tempted to focus more on your home’s appearance than its condition…both are very important to home buyers! In Texas, a home inspection report “sticks” with the home for four years. That means that if you get a contract on your home, and the Buyers do inspections, and then back of of the deal (“exercise their Option”) due to repair issues, you will have to attach that inspection report to your Seller’s Disclosure to inform all potential buyers about the issues with the home. (This is Texas law.)

This means that you want to prepare your home in advance, so that very few items are listed on the inspection report!

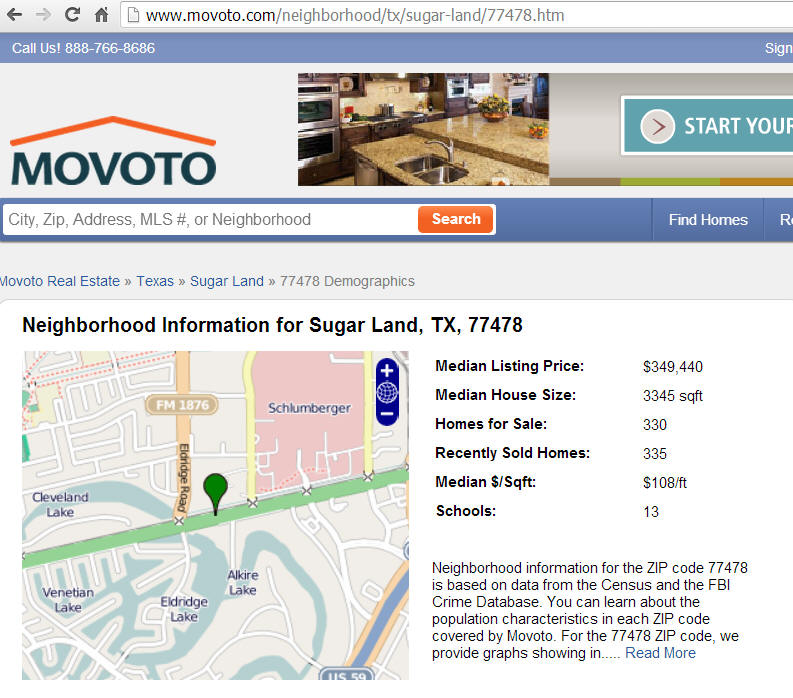

So do the following items when listing your home for sale, and especially a few weeks before an inspection. These are the most common things that will be listed on an inspection report in the Katy and Sugar Land area. These are also the types of things that “kill deals” and cause Buyers to “exercise their Option” to cancel the contract. Smart home owners side-step these issues by resolving them in advance of listing their home.

#1 – Get the HVAC System Serviced

The number one issue with buying and selling a home in Texas is the HVAC (heating, ventilation, air conditioning) system. Home inspectors will test the cool air blowing inside the home and compare that to the outside temperature to find the “differential.” Even if you THINK the system is working properly, it probably isn’t good enough for an inspection report.

Generally speaking, you want an air differential of 16-20 degrees. Home inspectors will also do other items to inspect the HVAC system but they will VERY OFTEN recommend that a “qualified HVAC professional check the system.” To head that off at the pass, you should contact your A/C company and have them check the system first. Make sure they fix any issues and then write the temperature differential on the receipt. Also make sure they check the heating elements and specifically write the condition of the heating elements on the receipt. (Home inspectors are not allowed or qualified to open the furnace to check the heating elements.) You need written proof of these items for most buyers.

One thing to understand…if the outside temperature is 65 degrees, minus a 16 degree differential, that equals 49 degrees. Most ACs will not work under 55 degrees. So you can’t properly inspect the cooling capacity of an HVAC system when the outside temperature is below 72 degrees.

Providing a Residential Service Contract (“home warranty”) may help you resolve concerns about HVAC systems, but not always. It’s best to have the system serviced, and provide WRITTEN PROOF, ahead of time. Send a copy of the receipt to the Buyer’s agent before the home inspection, so they can give it to the home inspector.

#2 – Walk the Perimeter and Repair Cracks in Brick Mortar Joints

Potential foundation issues will scare buyers off faster than most anything else when buying a home (read details). Since we live in an area with expansive clay soil (which is susceptible to our frequent floods and droughts) it is common for the brick and mortar around the exterior of a home to crack…especially at bay window and wall joints. Cracks do not, necessarily, mean there is a problem with the foundation. Most exterior cracks in the mortar, and interior cracks in the sheetrock, are indicative of typical “settling” in our area. However, most buyers do not understand that and will just move on to the next available home…passing yours by.

Here is a must read for Texas home owners: Buyer’s Guide to Slab-On-Ground Foundations by R. Michael Gray, P.E. and Matthew T. Gray, EIT.

If you have any concerns about your foundation, don’t ignore them and hope they will go undetected. Call a reputable foundation company and have them give you an estimate. Most of the time, there is no issue, so having that information in writing is beneficial.

Make sure you properly seal up cracks in mortar to prevent water and pest intrusion. But never DIY these repairs with stuff you can buy at Home Depot!! Hire professionals so the repairs will be invisible. Also repair interior cracks in ceilings and sheetrock, but again, hire a professional so they will be done properly. These repairs are relatively inexpensive and well worth the price if it prevents buyers from avoiding your property.

Read: Will Prior Foundation Repairs Effect a Home’s Resale Value?

#3 – Get the Pool Equipment Serviced

If you have a swimming pool, even if you think it is working properly, have it serviced and especially make sure the pool heater (if any) has the pilot light lit so it can be tested during an inspection. Make sure your “pool guy” writes the condition of the equipment on a receipt and keep it to provide to buyers. Also make sure the pool pump is clearly labeled, all switches for lights and water falls are labeled, and clearly label the GFCI outlet.

#4 – Get the Sprinkler System Serviced

Most buyers want to ensure that the sprinkler system works properly…especially the backflow device (which keeps yard contaminants out of the homes main water supply). Make sure that your sprinkler control box is clearly labeled for “which zone is which.” Example: Zone 1 = Front flower beds. Also attach a copy of your sprinkler’s instruction manual in a clear, plastic paper protector and staple or thumbtack by the control panel.

#5 – Replace Burned Out Light Bulbs (or Fix the Light Fixture)

If an inspector turns on a light and nothing happens, they don’t know if the bulb is burned out or if they fixture doesn’t work…so it will go on the inspection report. It’s easy enough to walk your house, including porches and garage, and make sure every single light bulb works. I recommend you use “bright white” (not daylight and not soft white) with the highest wattage allowed for the outlet.

Beware of using energy efficient “pinkish” light bulbs that take several minutes to warm up. Usually the buyer is ready to leave by the time those lights bulbs warm up, so the house looks too dark.

#6 – Ensure All Sink and Tub Drains Work Properly

Go through your home and make sure none of the drains are clogged up. Slow drains will go on an inspection report. While you’re at it, if you have a whirlpool tub, fill it up and pour 2 cups of bleach into the water and run for a few minutes to clean the jets internally. If you do’t use the whirlpool regularly, you may be surprised with the “black gunk” that will appear in the water!

A plumber recommended Thrift Drain Cleaner (buy on Amazon) to me and it works great! I use it to maintain the drains in my own home.

#7 – Repair All Leaky Faucets and Underneath Sinks

Check all the faucets and underneath all the sinks in the home to make sure there are no leaks. Hire a handyman or plumber (more expensive) to fix or replace leaky faucets and sinks. Also repair previous water damage (if any).

#8 – Get the Electrical Panel (Breaker Box) Up to Code

Electricity scares most people and electric codes change year to year. Just to be safe, have a qualified electrician check your electrical box/panel and make sure it will pass an inspection. Make sure the breakers are properly labeled. Also make sure there is easy access to the box and there are no wasps nests growing in or around it. (Yes, I’ve seen this!)

#9 – Lower the Soil/Mulch Level Around the Foundation

One of the most common items to go on an inspection report is that the soil/mulch line is too high around the foundation. Since termites are a problem in our area, and they build mud tubes along the foundation to get into the wood frame of the home, inspectors like to see 4 to 6 inches of foundation to ensure there are no termite tubes. If your soil or mulch is too high around the house, they can’t see the foundation and they will report it.

Hire your yard guys to rake back the soil and mulch from your foundation.

#10 – Fix Drainage and Gutter Issues

Home inspectors are very picky about possible drainage issues. Make sure your yard is properly graded to drain water within 24 hours. If you have spots that tend to “puddle” for more than a day, then have them filled-in or install a proper drain.

Also make sure your gutters are clear of debris. Home buyers don’t want to buy a home that needs a lot of attention like this and it’s easy enough for you to take care of before an inspection.

#11 – Repair and Paint Wood Rot & Caulk the Exterior Windows and Doors

Water is what typically damages a home. If you have any rotted wood around your home, have it replaced by a handyman. Also have a handyman or painter check every single exterior window and door of your home for separations and cracks and recaulk them as needed.

#12 – Repair Roof Leaks Properly and Repair Ceiling Damage As Well

No one wants to buy a house with a bad roof. Plus, if the roof is really bad, then the buyer may not be able to get home insurance, which means they will not be able to buy your home. (Lenders will not loan money to buy uninsurable homes.) So fix any known roof issues in advance and professionally repair interior damage (water spots on ceilings or walls).

#13 – Repair Broken Glass in Doors and Windows

No one wants to buy a home that has broken windows. Carefully walk your home and inspect each and every window and door and have all broken glass replaced. It’s usually relatively inexpensive to do this. Also make sure all doors and windows open and close and lock properly.

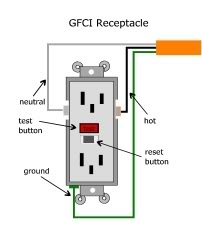

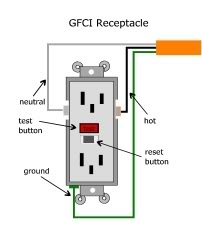

#14 – Label “Unusual” GFIC Outlets and Light Switches

A ground-fault circuit interrupter (GFCI) is the only protection device designed to protect people against electric shock from an electrical system. Most of the time, these outlets are obvious with Test and Reset buttons. However, you can connect a regular outlet to an outlet with a GFCI so that it is protected, but it will not be obvious to the inspector. So if you know you have some outlets like this, especially in the kitchen or bathrooms, then clearly label those outlets and specify the GFCI outlet they are tied to. This is something that inspectors can’t just “know” by looking at it, so they will mistakenly report this on an inspection report.

A ground-fault circuit interrupter (GFCI) is the only protection device designed to protect people against electric shock from an electrical system. Most of the time, these outlets are obvious with Test and Reset buttons. However, you can connect a regular outlet to an outlet with a GFCI so that it is protected, but it will not be obvious to the inspector. So if you know you have some outlets like this, especially in the kitchen or bathrooms, then clearly label those outlets and specify the GFCI outlet they are tied to. This is something that inspectors can’t just “know” by looking at it, so they will mistakenly report this on an inspection report.

#15 – Ensure Accessibility to Attic Doors, Garage Doors, Sprinkler Panels, Etc.

A home inspector cannot inspect what they cannot get to and they will not move things to obtain access. So make sure that your garage is not so packed with stuff that the attic door (if any), breaker box, garage door openers, electrical breaker box, or sprinkler control panel is blocked. Make sure no car is in the garage, blocking an attic door as well.

#16 – Inspect the Stucco Exterior and Resolve All Issues

Many home owners love the look of stucco, but it is really a terrible substrate to use for homes in a moist and humid climate like Houston. If you have a home with stucco, make sure you maintain it properly (and annually) because moisture in walls can cause serious problems…including mold hazards. Before listing your stucco home, have it inspected by a professional stucco inspector and make all repairs in advance.

The highest repairs I have ever seen in my 10+ years as a real estate agent added up to $14,000 in stucco issues.

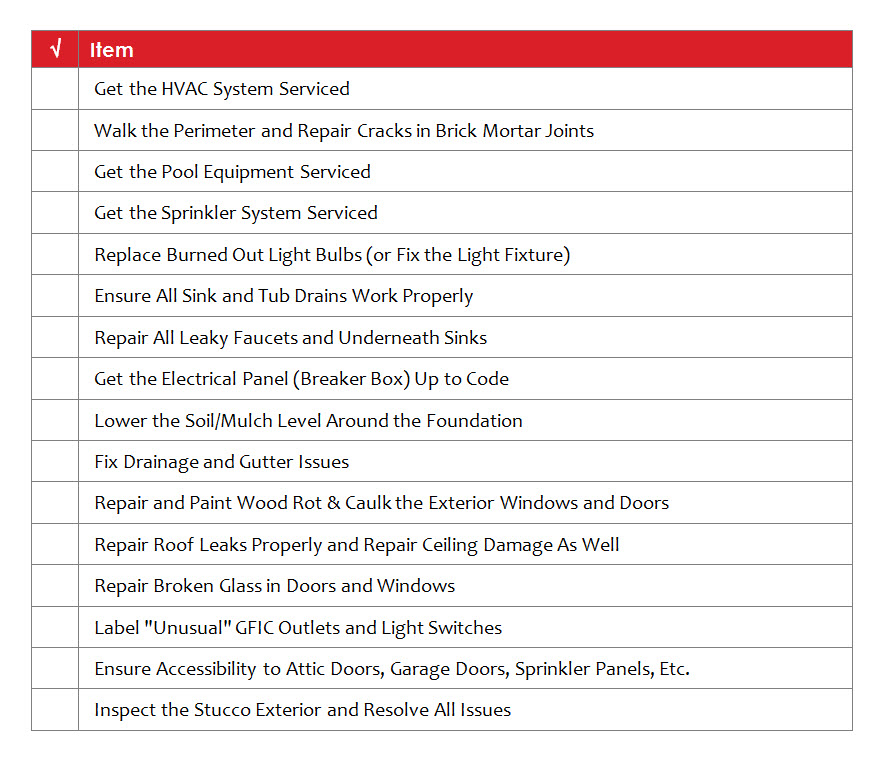

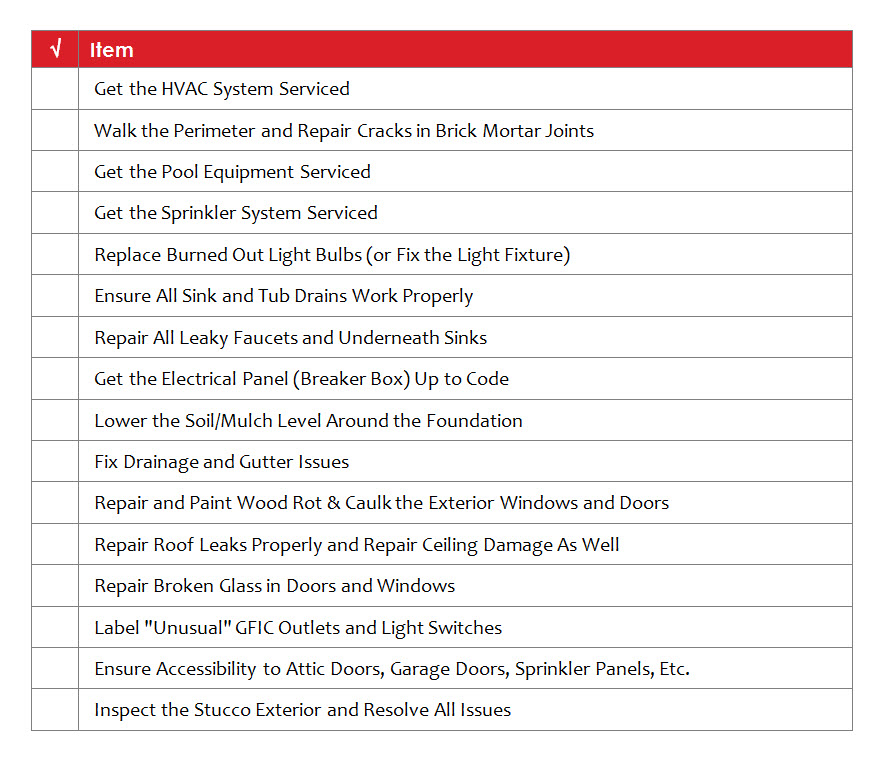

Checklist: Sixteen “Must Do” Items To Prepare Your Home for Inspections

See Also:

FHA Repair Requirements and Guidelines for Loans

Get the Report!

Get the Report!

A ground-fault circuit interrupter (GFCI) is the only protection device designed to protect people against electric shock from an electrical system. Most of the time, these outlets are obvious with Test and Reset buttons. However, you can connect a regular outlet to an outlet with a GFCI so that it is protected, but it will not be obvious to the inspector. So if you know you have some outlets like this, especially in the kitchen or bathrooms, then clearly label those outlets and specify the GFCI outlet they are tied to. This is something that inspectors can’t just “know” by looking at it, so they will mistakenly report this on an inspection report.

A ground-fault circuit interrupter (GFCI) is the only protection device designed to protect people against electric shock from an electrical system. Most of the time, these outlets are obvious with Test and Reset buttons. However, you can connect a regular outlet to an outlet with a GFCI so that it is protected, but it will not be obvious to the inspector. So if you know you have some outlets like this, especially in the kitchen or bathrooms, then clearly label those outlets and specify the GFCI outlet they are tied to. This is something that inspectors can’t just “know” by looking at it, so they will mistakenly report this on an inspection report.